Save this article to read it later.

Find this story in your accountsSaved for Latersection.

What do you think about gas in the tank for the long term?

asks Cindy Holland, Netflixs vice-president of original content.

She notes themixed reviewsforLost in Space.Do we care?

Not that much, it turns out.

The show is renewed for a second season.

Theres enough gas in the tank, they decide,for a season three.

Do you have a clear sense of who is that core fan base?

You probably also get the sci-fi audience as well, right?

I dont think were going to get a hard-core sci-fi action audience, the executive replies.

Thats not what this is.

Also on the agenda is a not-yet-announced limited series.

Theres a brief debate over which of Netflixs many content verticals it will fall under.

Its kind of a hybrid between series and film in terms of the biopic nature, one executive says.

Right now, its projected somewhere between period romance and the black-film vertical, says another.

Adds someone else, It doesnt fit squarely in either, so we think theres a nice in-between.

Netflixs overthrow oftelevisions old business model began just seven years ago.

It plans to spend $8 billion on content this year.

Netflix doesnt want to be a streaming, supersized clone of HBO or FX or NBC.

Its trying to change the way we watch television.

The service has offered streaming since 2007.

And last month, it announced a deal withBarack and Michelle Obamato make TV shows and movies.

The first word out of everybodys mouths in meetings is, How do we deal with Netflix?

says one longtime TV-industry executive.

How do we compete with Netflix?

What are they doing?

The proposed AT&TTime Warner merger is similarly designed to help AT&T take on Netflix.

The thing that keeps me up at night is scale, says Sarandos.

Its a mind-boggling amount of programming thats being produced here.

How do we keep scaling it?

One answer is cultural.

Thats not just New Agespeak.

Two layers beneath Cindy have full greenlight authority, Sarandos says.

Most of my team have more buying power than anyone has selling power in Hollywood.

My direct-report team can greenlight any project without my approval.

They can greenlight itagainstmy approval!

I ask Sarandos to give me an example of something thats gotten made over his objections.

He citesWhat Happened, Miss Simone?, the documentary from director Liz Garbus.

We fought about it for six months, he recalls.

Shed come back and explain to me why this isnt a music doc.

She was 100 percent right and I was 100 percent wrong.

Sarandos was similarly iffy onAmerican Vandal, last summers comic mockumentary that ended up being a word-of-mouth hit.

Lower-level executives arent completely free agents.

They have some budget constraints, Sarandos says.

This [idea] that if you have volume, you cant have quality?

I think its convenient for people who are limited by time slots or budget.

Why cant you have more than that?

We have the ability to support a larger number of artists than most people can.

While theres still roomto grow domestically, Netflixs biggest opportunity for scale is overseas.

On the documentary side, people pointed to box office to say, See?

He lets the group in on some discussions hes been having about the show with Sarandos.

Barmacks staff, many of whom hail from outside the U.S., dont seem keen on the idea.

Were making a point that there can be great fiction that is not English.

When we turn it into English, were giving it the status of being not as important.

Later, I ask Barmack how he would move forward given the pushback.

For me, there are three buckets, he says.

The data, the art, and the regional sensitivity.

Ill look at the data, and if everyones against it, its unlikely Ill do something.

If its a 50-50 thing, Ill just make the call.

And I was like, Boom.

That would be amazing.

Sarandos, however, says he doesnt like to limit his options.

Theres no such thing as a Netflix show.

That as a mind-set gets people narrowed.

Our brand is personalization.

That quest for personalization explains why Netflixs U.S. originals keep nosing into new genres.

Because of Netflixs Silicon Valley roots, many assume the companys vaunted algorithm is where its decision-making process starts.

But at almost every opportunity, Sarandos and Holland downplay the role data plays.

And the data just tells you what happened in the past.

It doesnt tell you anything that will happen in the future.

On one level, it was a massive failure that we didnt see that coming, he says.

Sarandos asked his team, What else are you highly confident about that you cant see coming?

(At least they wont underestimate Covell again.

Theyve just given her a ten-episode order forKaos, a dark hourlong comedy reimagining Greek mythology.)

I ask for it and never get it, he says, laughing.

I am always like, Who do people like?

You guys know everything!

It would be really interesting for me to know.

And yet, Big Data is unquestionably part of the DNA at Netflix.

But Netflixs data allows it to be vastly more precise, giving it an enormous competitive advantage.

Whats different at Netflix is the companys desire to fill so many of these categories with content.

The phrase, along with the interchangeable taste communities, comes up time and again during my visits.

We would use that information to recommend shows.

Where taste communities and Nielsen demos differ is in the way theyre used.

Most people are usually members of a few different communities, she says.

Were complex beings, were in different moods at different times.

To show Grants team how this works, De Carlo gives a PowerPoint presentation.

But after we launched the show, were able to start to see patterns.

LostandBlack Mirroris also a stretch.

Linear networks have their own way of driving audiences to shows.

A good time slot or a promo duringThe Big Bang Theorycan get viewers to sample something new.

But linear TVs promotional tricks are inefficient and miss out on wide swaths of potential viewers.

Yellin describes whats on the screen: Heres Alison Brie.Theres Marc Maron.

Theres a womans lips; theres just two cats fighting, he says.

Eight percent for this one with Betty Gilpin; the Marc Maron one gets 6 percent, he says.

What image is unlocking them to playGLOWorOzark?

Relative to the size of the watching of a show, we want the show buys to make sense.

Nothing is too niche, he says.

Its just relative to what it costs.

Eventually, theres opportunity cost.

We try not to program for ourselves.

Weve had to cancel shows that Ive loved.

Yeah, but our fans are trusting us to spend their subscription money well, he says.

Those are the choices we have to make for them.

And they can cancel Netflix with one click.

Both have modest budgets and lower-than-expected viewership.

So why did one die a quick death while the other will live another year?

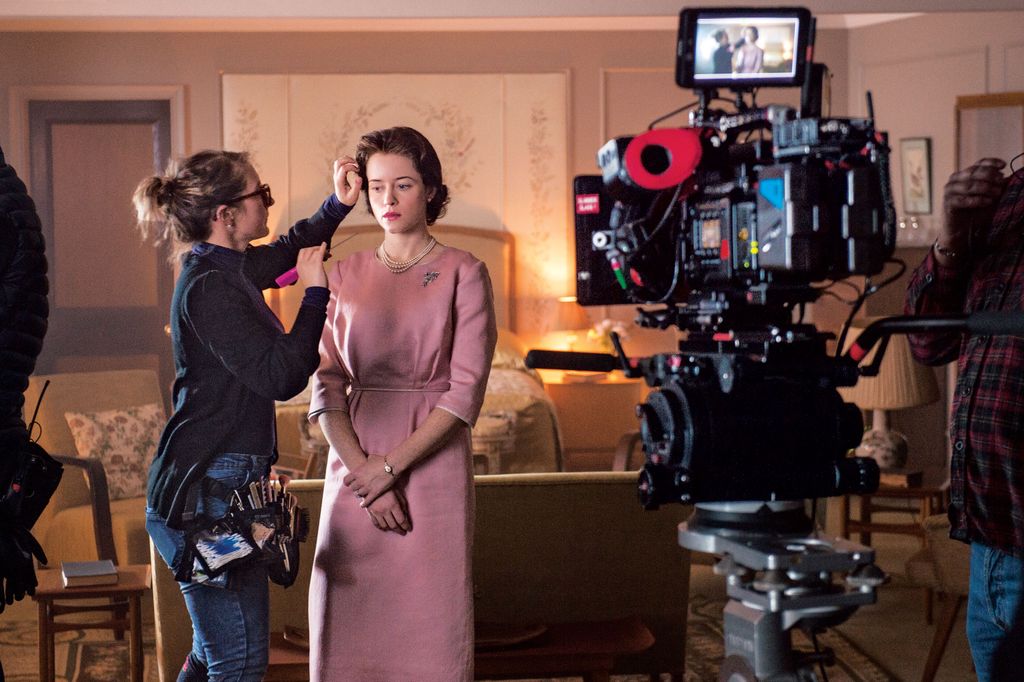

(A season of that show cost like two-thirds of an episode ofThe Crown, my source says.)

It sucks that it didnt have a broader audience, Holland says, leaning into the pun.

We couldnt get out of that core appeal.

But it wasnt just that not enough people watched.

Among those who did, a smaller-than-average number were completing it, Holland says.

In the case ofSucks,not a lot of people did.

Were not trying to encourage that, Sarandos says.

The completion of a single episode is a more important trigger.

Its 70 percent gut and 30 percent data, Sarandos says.

Most of it is informed hunches and intuition.

Data either reinforces your worst notion or it just supports what you want to do, either way.

That may be one reasonOne Day at a Timeis still around.

It has a good audience, Holland tells me.

Latino for sure, LGBT for sure, female for sure.

And it tells a different story than is being told on Netflix.

Ive certainly pitched shows theyve turned down, she tells me.

Holland and her team turned down the idea.

Thats showbiz, Kohan says.

I think they thought it was too niche.

Does she think the project was killed because Netflixs data told the company it didnt make sense?

I know they love them their algorithms, she says.

But I mean, theyre also people.

So we felt that it probably wasnt going to be a particularly global show for us.

We also had a lot of questions about how you maintain legs on that story over many seasons.

The good news for Kohan and Denbo is thatAmerican Princessis still getting made.

I wish it were at Netflix, she says.

I really dont like having to deal with a cable web connection at all.

Im probably biting the hand that feeds me for saying that.

Sometimes outside factors weigh on a programming decision.

Sarandos tells me getting rid of Spacey wasnt difficult.

The hard part was, what about the 300 people who make this show?

What about the 2,000 people in Baltimore who depend on that show for their living?

But he wont say how many fans.

IsStranger Thingsthe biggest show on Netflix?

I ask Sarandos during one meeting.

About 300 million, he says.

Yeah, of course, Sarandos offers.

Has that already happened?

Definitely, he says.

Its better than Rotten Tomatoes.

The chart lists the top-30 new shows of the 201617 TV season.

Fourteen of them are Netflix original shows, he brags.

No one else on this list has more than three shows.

In [IMDbs] popularity rankings right now, its the No.

4 movie behindDeadpool 2, Avengers: Infinity War,andSolo,he says.

Jacob Elordi is the male lead.

Three weeks ago on the IMDb Star-o-Meter, which is how they rank their popularity, he was No.

Today he is the No.

1 star in the world.

And Joey King, the female lead, went from like No.

This is a movie that I bet youd never heard of until I just mentioned it to you.

This is the competitive message you hear out of a couple of different networks and studios all the time.

It is so wrong, he says.

The people who watch my shows are nontraditional TV viewers who are interested in nontraditional fare.

Rhimes says she never paid attention to Nielsen numbers, even when they supposedly mattered.

I didnt want to see that deal go anywhere else.)

Weve gotten to the level that we have without much attrition on that side, he says.

Theres been some cord-cutting, some cable-thinning, I guess they call it.

But HBO hasnt lost a single [subscription] since our growth has gone up.

Part of our ability to keep growing is based on having a healthy competitive landscape.

Netflix also doesnt win every project, Sarandos says.

We get outbid all the time all the time, he says.

But right now, the average American cable bill is about $100 per month.

Theres plenty of room for multiple players to be successful in this space, Sarandos says.

If you loveGame of Thrones,you dont cancel HBO to join Netflix.

Not that Sarandos thinks competing with Netflix is going to be easy, particularly for old-media companies.

I dont think its in their DNA, he tells me.

We dont jam the tech culture on the entertainment company and vice versa.

That is whats different about the Netflix story from everyone else.

People underestimate the 1,000 engineers in Silicon Valley who make Netflix work every single time you push play.

You either believe or you dont.

However, painting Netflix as the villain on the TV landscape might also be giving it too much credit.

And some of them will go away, or at least adapt to survive.

Its easy to imagine some very big cable networks shuttering over the next half-decade.

I ask Sarandos when hell know its time to hit the brakes.

But we are not seeing any evidence in either metric yet.

Theres tons of growth in user screen time on Netflix, he says.

If you think about the addressable market for Netflix as being paid TV households, its relatively small.

Everyone with a phone has a screen and access to the internet.

That is our addressable market.

The worlds taste, and the worlds time, is what were after.